Weather happens...and this past week it happened hard in NYC. Snowstorms cancelled flights into and out of the Northeast and left people stranded for days. The trip delay reimbursement benefit on some credit cards can help you get your lodging and meal expenses paid for when airlines leave you stranded at the airport.

So what is trip delay reimbursement? Not to be confused with travel accident insurance or baggage insurance–which most credit cards have–this benefit covers certain expenses when your flight is delayed for a certain amount of time (12 hours or more seems to be the average). Amazing right? Better yet, this DOES include weather (as well as mechanical issues, strikes and a few other covered issues).

Here's a short list on what cards and services provide and don't provide this benefit:

Travel Insurance: Travel insurance usually covers trip delays. It's an added cost... but could be worth it if you don't have a card with this benefit during snow and hurricane seasons.

Airline Carriers: Although each carrier is different, they tend to provide this only regarding issues that are considered their fault, such as mechanical failure. They do not cover weather-related incidents (or basically 99% of the time you'll actually need this).

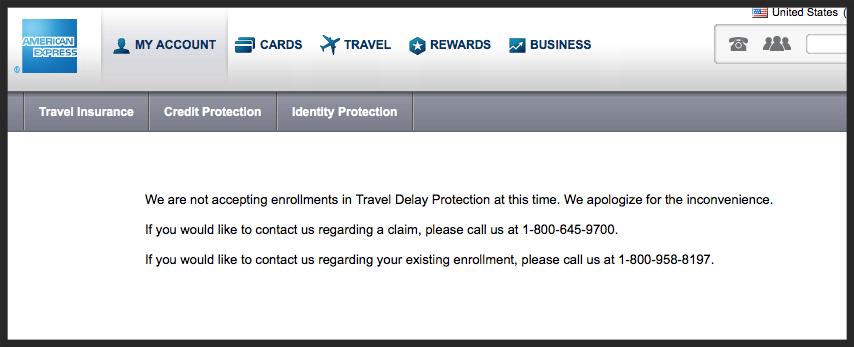

American Express: American Express, as of this writing, no longer offers trip delay protection. (See screenshot). Oddly enough for how many people boast about the benefits of this brand... this was never included on their cards and charged $9.95 a person per trip if they wanted it!). Many blogs have mentioned that the Platinum card offers this, but after a quick call to their Platinum dedicated line, I can confirm that it doesn't.

[caption id="" align="alignnone" width="854.0"]

American Express no longer offers their version of trip delay reimbursement. [/caption]

American Express no longer offers their version of trip delay reimbursement. [/caption]

Mastercard World Elite: The general level of Mastercard World Elite does not cover trip delay reimbursement.

Discover: The Discover Escape card has it! Not my favorite brand as many everyday merchants don't take Discover, though.

Visa Signature: The general level of Visa Signature does not cover trip delay reimbursement. Certain bank issued cards do, though... read on!

Chase: The cream of the crop when it comes to travel protection benefits included with your card. The following Chase cards include trip delay insurance: (h/t to Deals We Like for the full list!)

Chase Sapphite Preferred

Marriott Rewards Premier Credit Card

Ritz Carlton Rewards

Hyatt Credit Card

Sapphire Preferred

Sapphire

Ink Bold Business Card

Ink Plus Business Card

Ink Cash Business Card

Ink Classic Business Card

United MileagePlus Visa

With these cards, if your flight has been delayed by 12 or more hours, you get up to $500 dollars to cover the costs of lodging and meals until your flight is rescheduled.

So there you have it! Remember, in order to be covered for ANY travel benefit on your card you have to charge the entire trip in full with that card. Even applying a gift card can make this benefit void. For all award travel and e-certificates applied... I would choose to go with travel insurance.

If you're going start booking all your airfare with a chase card because of this... my top pick is the Chase Sapphire Preferred card.

Hope that helped out! Safe travels!

No comments:

Post a Comment